Top View Text Cit Calculator Magnifying Glass Pen Financial Charts Stock Photo by ©andreiaskirka 477179400

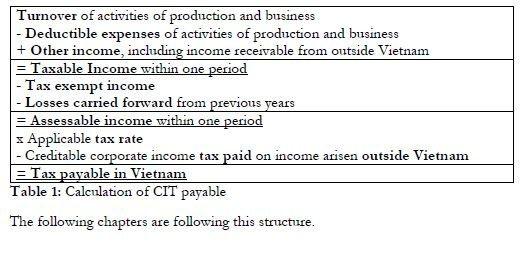

The science and art of midwifery. given date, which has since his time been generallyadopted. This consisted in counting forward nine months, or, whatamounted to the same thing, counting backward three

1 Speaker Name: André Marius Le Prince Company:WLP GmbH, Hamburg, Germany WIRA AG, Munich, Stuttgart, Düsseldorf, Nurnberg, Hamburg, Germany Phone: ppt download

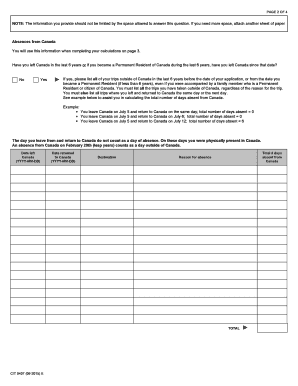

Fillable Online CIT 0407 E : How to Calculate Physical Presence - Immigroup Fax Email Print - pdfFiller